On 10 October 2018, the Thai government announced the cessation of the International Headquarters (“IHQs”) program (which also included Regional Operating Headquarters or “ROHs” and International Trading Centers or “ITCs”) and the creation of a replacement initiative; International Business Centers (“IBCs”).

The move is part the OECD Inclusive Framework for Base Erosion and Profit Shifting (“BEPS“). Under this framework, Thailand has agreed to implement four of the BEPS minimum standards: BEPS Action Item 5 (Harmful Tax Practices), BEPS Action Item 6 (Tax Treaty Abuse), BEPS Action Item 13 (Transfer Pricing Documentation), and BEPS Action Item 14 (Dispute Resolution Procedures).

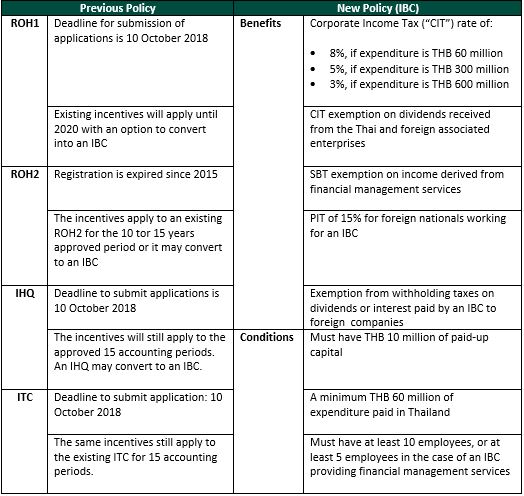

Comparison of the New IBC and the previous IHQ/ROH and ITC schemes

Tax incentives provided under the New IBC scheme:

- CIT reduction on income from services, royalties and financial managements received from Thai and foreign associated enterprises. The CIT rates are as follows:

- CIT 8% on expenditures of THB 60 million in Thailand;

- CIT 5% on expenditures of THB 300 million in Thailand; and

- CIT 3% on expenditures of THB 600 million in Thailand.

- CIT exemption on dividends from the Thai and foreign associated enterprises.

- Specific Business Tax (“SBT”) exemption on financial management services from Thai and foreign associated enterprises.

- PIT rate of 15% for foreign nationals.

- Exemption on withholding taxes on dividends or interest paid from an IBC.

Conclusion:

Applications for the existing IHQ and ITC schemes will no longer be accepted as of the date of the announcement on 10 October 2018. Any new applications will be under the new IBC scheme. The IBC incentives are likely to be viewed as less attractive than what was previously available under the IHQ scheme. Under the IBC scheme, income including service fees, royalties and capital gains are no longer provided with an exemption from CIT in Thailand.

The existing Thai IHQ scheme was starting to become popular as an alternative to Singapore and Hong Kong for structuring investments in South East Asia. The need for high annual expenditures by the Thai IBC may deter companies from establishing a regional presence in Thailand. Companies interested in establishing a regional headquarters or treasury office may look to alternative countries to structure their holding and treasury functions.

We will be providing further commentary on this in due course

Please let us know if you have any queries or if you would like additional information.

DFDL Contacts

Jack Sheehan

Partner,

Head of Regional Tax Practice,

DFDL Thailand

jack.sheehan@dfdl.com

Tax Director,

DFDL Thailand

The information provided here is for information purposes only, and is not intended to constitute legal advice. Legal advice should be obtained from qualified legal counsel for all specific situations.